There’s no simple answer as to whether paying an early mortgage redemption fee will save you money in the long run. It depends on your current circumstances and what you want in the future.

With the looming cost of living crisis, record inflation and rising interest rates, it’s easy to see why so many of us are wondering what to do for the best. With more people asking if paying their mortgage redemption fee is a sensible move, we’ve compiled our guide to help you make informed decisions.

What is a Mortgage Redemption Fee?

When you take out a mortgage, you generally have various mortgage fees. A mortgage redemption fee (or early redemption penalty) is often one of them, but not one everyone knows about. What exactly is it? In short, it’s an exit fee.

A mortgage redemption fee is an early repayment charge you may have to pay if you leave your deal early, opt for an early mortgage payoff or switch to another lender.

For example, if you sign up for a 5-year fixed deal but decide you want to move to a different deal after 3 years, your lender will, most likely, charge you an early repayment charge. Likewise, if you pay off your entire mortgage, or even a big chunk of it early, your lender will impose a fee.

Lenders charge this to help them recoup some of the interest they’ll miss out on by you not making monthly payments. They expect to earn a certain amount from your repayments, so they pass their loss onto you via a mortgage redemption fee.

Not every lender will do this and the amount you’ll pay varies greatly with each mortgage, so it’s worth knowing all the details before you agree on a mortgage.

How Much is a Typical Mortgage Redemption Fee?

As with most mortgage fees, there isn’t a set amount for how much your early exit fee is. But breaking a mortgage early can end up being a costly manoeuvre. Early repayment charges can potentially cost thousands on top of additional admin fees.

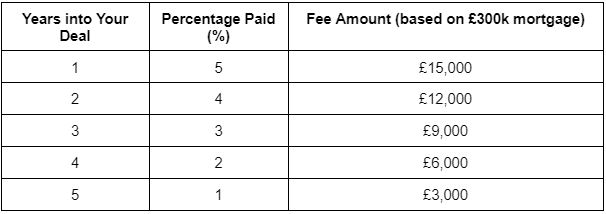

Your mortgage redemption fee is usually a percentage of your remaining loan ranging from 1-5%. How far you are into your deal also has a big impact on the overall cost.

For example, on a 5-year fixed mortgage, you might pay 5% of your loan amount if you leave in year 1, 4% in year 2, 3% in year 3 etc.

If your mortgage is £300,000, you could end up paying £15,000 in exit fees if you break the deal in the first year. By the last year of your 5-year fix, it would be less than £3,000 (assuming you’ve paid back a portion of the loan by then). See the table below for a rough guide:

Of course, the smaller your mortgage, the lower your mortgage redemption fee is. If you’re on the last £15,000 and want to leave your mortgage deal in the last year, you’ll only pay 1% of £15,000. A grand total of £150!

When you combine potential mortgage fees with the costs of buying a home, you’ll see why you need to weigh up your decisions so carefully.

Is it Worth Paying the Early Mortgage Redemption Fee?

With rising interest rates, many people are wondering whether they should pay their exit fees to secure a new mortgage deal sooner. If you manage to find a lower interest rate than you may be able to get in the coming years, you could save thousands of pounds on your mortgage. You may prefer to secure a rate sooner than the current deal’s end date if you believe rates will increase far more in the coming months/year too.

Of course, any potential savings could be counteracted by other mortgage fees, such as exit fees, broker fees, solicitor costs and arrangement charges with a new lender. You should consider these costs and use our mortgage cost calculator to work out your monthly payments before deciding on how you want to proceed.

Keep in mind that you can often lock new deals in for up to 6 months. If your deal ends in 6 months time, start shopping around now to find the best deal you can. Having a deal pre-arranged saves you going onto the expensive standard variable rate (SVR). Delaying it until after the end of your fix saves you from paying hefty early mortgage redemption fees too.

Read more about when you should and shouldn’t remortgage your home.

Can I Avoid Early Mortgage Payoff Fees?

If you’re looking to overpay, most lenders give you a 10% leeway. This means you can overpay 10% of your mortgage each year without paying any interest on your overpayments.

This isn’t a guarantee, so check the deal with your lender to avoid paying any surprising mortgage fees. This often does not apply to full redemption either.

Generally speaking, waiting until the end of your deal is the best way to avoid early exit mortgage fees. It’s rare for a lender to not have early repayment charges in place. If they do, it’s generally only for their standard variable rate (SVR), which is an expensive option anyway.

It can be worth sticking on the SVR if you know you’re selling soon to avoid the costly exit fees associated with signing a new deal.

Mortgage Advice at Stuart Brown Mortgage Services

Unfortunately, there’s no “one size fits all” approach to mortgage redemption fees and whether to choose an early mortgage payoff. It depends on your individual situation and the factors we’ve mentioned above.

At Stuart Brown Mortgage Services, we understand the importance of finding the right mortgage deal. It’s one of the biggest financial decisions you’ll ever make, after all.

We’re here to help you navigate your way through this crucial decision-making process. We offer expert mortgage advice to find the best deal for your individual situation and your future plans. Contact us today for more details and to make an appointment.

Stuart

email: advice@sbms-online.co.uk

Telephone 01525 877650 or 01442 252040

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner