Fixed Rate and Capped Rate Mortgages

Fixed Rate Mortgages

A fixed rate or fixed term mortgage is a common type of mortgage scheme where the rate of interest is fixed and remains the same throughout the agreed term. Unlike a variable rate mortgage, this consistency allows homeowners to make predictable monthly payments as the payment will not change despite the fluctuating interest rates.

Currently, on the market, there are more fixed-rate mortgages available than any other type of mortgage deal. This is due to its popularity with both lenders and homeowners.

Fixed interest rate mortgages are typically offered in two, three and five-year terms. However, market forces paired with the lenders trying to offer competitive products, can lead to longer (and shorter) terms being offered too.

Although they are not as common, it is possible to be offered up to a 15 year fixed-rate mortgage term. The rates on offer will differ, for example, a 2 year fixed-rate mortgage is often cheaper than a lengthier, 3 or 5-year scheme.

It is very important to carefully consider the length of time you choose to fix your mortgage, which is why here at SBMS we can provide you with expert advice and guidance throughout the whole process.

Fixed Term

When it comes to fixed term mortgages, the longer your deal is set to last, generally the higher the interest rate will be on the mortgage. This is because it’s more difficult for the lender to predict what will happen in the market over longer time periods.

Therefore in this situation, you’re practically paying for the security of knowing that the interest rate will not increase, irrespective of what is happening in the market, for a specific period.

Once a fixed-rate period has come to an end, you will be transferred onto a standard variable rate (SVR) mortgage by your lender. Each lender sets their own standard variable rate and this can change by any amount, at any given time.

It is advisable to consider a remortgage to a new deal once this happens to make sure you continue to pay as little as possible (as well as obtaining the stability of a fixed payment again). This could be with your existing lender or a different provider. We can start to look at this up to 6 months before your current fixed period is set to end.

If you have any questions on fixed rate mortgages, contact us today for expert advice and guidance.

Capped Rate Mortgages

Capped-rate mortgages are an uncommon type of variable rate mortgage where the interest rate you are charged is limited or capped, at a certain rate for a period of time. This kind of mortgage is sometimes offered in conjunction with tracker schemes.

The interest rate ‘cap’ means your payments cannot rise above the agreed percentage from your lender. This is a good option for those who want peace of mind knowing that your monthly mortgage repayments will never go above a certain amount. However, failure to keep up with these payments can result in home repossession.

Capped-rate mortgages are normally only available for an introductory period, ranging from from two to five years. Once the agreed term has finished, you’ll then be moved onto the provider’s standard variable rate (SVR).

It is important to note that some capped rates will also have ‘collars’, effectively a minimum rate that will be charged (the rate you pay can only reduce to a certain level).

Capped rates are not a common scheme and can have a slightly higher pay rate than an equivalent fixed rate.

Capped Mortgages

Capped mortgages guarantee that your payment will not go above a certain level. As a variable-rate, they also allow you to benefit from interest rates going down which leads to lower payments.

This mortgage is the only rate type other than fixed-rate mortgages, that provides you with payment security. However, as you are paying for the security which the cap provides, this rate type tends to offer higher rates than equivalent fixed, tracker and discounted rate mortgages.

If you have any questions on capped-rate mortgages, contact us today for expert advice and guidance.

Early Repayment Charges (ERC’s)

Most schemes will have early repayment charges attached to them. This means if you do not keep the mortgage under the agreed scheme, for a specified period, then a penalty or ‘early repayment charge’ would become payable.

These charges are often expressed as a percentage of the loan being repaid and as such can run into thousands of pounds.

This is an aspect we will cover with you when shopping around for a suitable scheme.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

Are fixed rate mortgages affected by inflation?

A fixed rate mortgage is set for a period of time (usually 2, 3 or 5 years). During this time your payments will not be affected by inflation or other economic factors (e.g. Bank of England base rate changes). Your monthly payments will remain the same for the fixed rate period.

-

How does a fixed rate mortgage work?

Your payments will not fluctuate with changing interest rates during the fixed rate period. If interest rates go up (or down) your payments will not change during this time.

-

What are the advantages of a fixed rate mortgage?

When interest rates rise, your payments will not. For the set period of your fixed rate mortgage you can be certain that your payments will not alter. Obviously, the downside is you will not benefit from rate reductions whilst on a fixed rate either though.

The main advantage is the ability to budget for a set period, often very important for First Time Buyers but also a good idea for many others too for instance those who may be stretching themselves too.

-

How does a capped rate mortgage differ from other types of mortgages?

A capped rate mortgage will be subject to the rise and fall of interest rates in the same way as a standard variable rate mortgage. The difference with a capped rate mortgage is that there is a set upper limit, over which the interest rate cannot go.

-

Is the capped rate mortgage interest rate fixed or variable?

It’s a variable rate mortgage, with a fixed upper interest rate limit. Your payments will vary depending upon interest rates, but will not exceed the agreed set level.

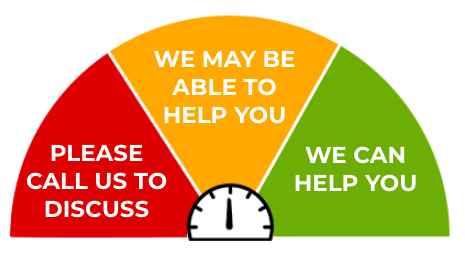

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner