Credit File Advice

If you are looking for credit file advice you have come to the right place, as our expert financial advisors here at Stuart Brown Mortgage Services can provide you with the support you need. Credit of any sort – from bank loans to mortgages and credit cards – has never been freely given by lenders. You have to prove you are in control of your finances. If you do, your chances of getting a loan when you need one will be greatly increased.

It has always been the case that lenders are choosy. If you are among those who have been refused credit recently or if you are thinking of applying for credit soon, do not panic – take action instead. A good place to start is your credit report, which lists your borrowings and how well you are managing your repayments. It gives you a snapshot of your credit history, what credit accounts you have had in the last six years and how you have coped.

Your credit report can also help you to see where you could cut back and whether you could close some accounts altogether. Lenders check it when they decide whether to make you an offer and, with some credit, what terms to set – such as interest rates. It is crucial that it is up to date and accurately reflects your circumstances. It pays to manage your money well because a better credit history makes you more likely to get accepted and obtain a better deal.

It is a common misconception that you have ‘a credit score’ when in fact although each of the providers below will show their interpretation of ‘a credit score’, you do not have a single score. Each and every application for credit is credit scored at the time of application.

This will take into account data on your credit file (from whichever agency the bank or financial institution uses) in addition to other aspects of the application/your situation

i.e. what you do for a living, how long you have been in your current job, marital status, if you are a homeowner, any children, conduct of credit, number of previous credit searches, type and purpose of credit, the percentage being borrowed etc.

The Three Main Credit Reference Agencies, UK

www.transunionstatreport.co.uk

Generally, each of these will offer a free trial period to your credit report and beyond that ongoing access for a monthly fee, Callcredit runs a free version of their credit file information (it only updates the data once a month whereas the other fuller reports show data to the previous day).

Please be aware that all the above also make money from affiliate services i.e. trying to convince you to switch utility companies and have links to credit providers too. You should take caution in the links provided and only take advantage of necessary offers. Certainly, be wary of anything that purports to ‘improve your credit history’.

One last point, you can obtain the information from the credit reference agencies at any time for payment of a £2 fee. This will provide you with a copy of your statutory credit report and credit history as a one-off snapshot. It contains financial information about you and lenders will use it to make a decision whenever you apply for credit.

You have the statutory right to access your personal credit information, and each company can charge no more than £2 under the Data Protection Act 1998 to for fulfilling each request.

Understanding your credit file is not easy, especially with a ‘score’ that can lead you to believe you are credit-worthy when in fact the data seen may point to the opposite.

Please contact us today if you require credit file advice or have any questions on the information above.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

How can I check my credit file?

There are a number of online credit reference agencies that you can use to check what is stored on your credit file. Your credit history is held on a database and you simply input some basic details. This is then used to generate a report and your credit score.

It is a common misconception that we all have ‘a credit score’. It is the information on each of the files along with other background data that lenders use to assess credit worthiness not the ‘score’ that is given by the respective credit reference agencies themselves.

Some lenders will use the information from only one agency, many use more than one though and the information on one agency’s file will usually partially differ from the others.

-

What is a credit file?

A credit file is a record that shows information relating to your financial history. It will show information such as currently outstanding and past debts (loans, credit cards, HP, car finance and more), your bill paying history, credit applications, previous credit searches, electoral roll information, address history and any financial links you have with others. It will also show credit history that may include late payments, defaults and CCJs.

-

What is a credit file check?

This is a check carried out by banks, building societies and other lending organisations, which show details about your finances. It is used to determine whether you are a good candidate for a mortgage. It can include information about your debts and credit applications. Utility and phone companies may also use your credit file information before entering a contract with you.

It is not the only information used to assess credit worthiness though as most lenders use their own credit storing system to work out what risk you are too.

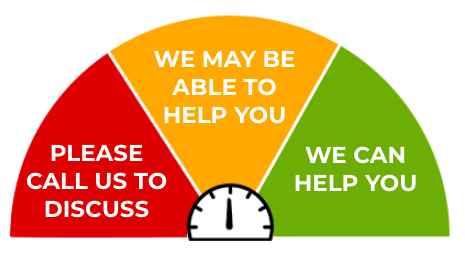

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner