Bridging, Development & Commercial Finance

Bridging

Our bridging loan brokers here at Stuart Brown Mortgage Services can provide you with the guidance you require on bridging loans. Bridging is a type of short term lending and typically more expensive than traditional forms of credit.

A bridging loan can provide fast access to funding and the money can be in your bank within days if the circumstances allow. Payments can be interest-only with an option to roll up the interest into the loan meaning no monthly payments to make.

Usually Bridging finance would be expected to run for 6 – 18 months, you would typically use it to ‘bridge’ a shorter-term need i.e. purchase of a property prior to the sale of another. If you want to find out more about bridging finance contact us today to speak to our bridging finance brokers.

Bridging Finance has many uses, such as:

- Avoid a chain break

- Capital Raise for business purposes

- Land Acquisition

- Refurbishment or remodelling of a property prior to refinance or sale

- Lease Extension Purchases

- Auction purchases

- Below Market Value Purchases

- Avoid Repossession prior to the sale of the property

Development Finance

Development finance may be used to:

- Self-build

- Complete a Refurbishment

- Do a Renovation

- Major Home Improvements

- Do a Conversion

- Carry out a small or large Property Development

Lenders will consider the overall proposition and your experience in this type of build before agreeing to aid with finance. They may lend you between 50 & 85% of costs to buy and build. We have links with different providers to aid with these so call us to talk further with our specialist property development finance brokers.

Commercial Finance

Commercial finance is often referred to as business finance or business funding as this is lending for commercial enterprises rather than individuals. Our commercial finance brokers can give you the guidance you need when seeking commercial finance.

This type of finance is aimed at businesses:

- Invoice financing

- Purchases and Refinance

- Lending on property or land

- Banking facilities

- Start-up finance

Call us today to speak to our commercial loan brokers regarding commercial finance.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

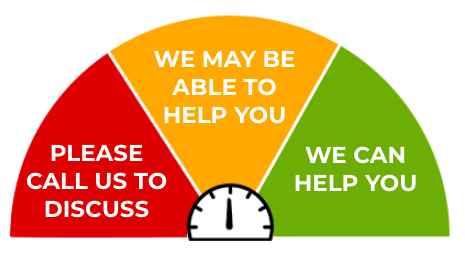

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner