Variable, Discounted & Tracker Mortgages

Variable Rate

The interest rate on a variable rate mortgage can change during the term of your mortgage, broadly in line with interest rates in the economy as a whole. A variable home loan may be useful if you want to keep your mortgage straightforward. You need to be sure that you can afford any potential increases to your mortgage payments in the future.

Tracker

A tracker mortgage scheme usually gives you cheaper monthly payments than you would pay under the lenders standard variable rate. Sometimes the scheme runs for a short period, otherwise, it may run for the life of the mortgage. The scheme pay rate is linked to the Bank of England base rate and can vary up or down. The pay rate under a tracker is often comparable to that offered under discounted rate schemes.

If you require tracker mortgage advice get in touch with us today to speak to one of our mortgage advisors.

Discounted Rates

Some lenders will offer a discount off their standard variable rate for a short period by a discounted variable mortgage. Usually, this will be between 3 months and 5 years. This means that you will have cheaper payments for a period of time. The rate that you pay could vary; additionally, once this discount has expired the interest rate will usually revert to their standard variable rate.

You need to be sure that you can afford potential increases to your monthly repayments during the scheme period and once this finishes.

Early Repayment Charges

Most schemes will have early repayment charges attached to them which mean if you do not keep the mortgage under the agreed scheme, for a specified period, then a penalty or ‘early repayment charge’ would become payable.

These charges are often expressed as a percentage of the loan being repaid and as such can run into thousands of pounds.

This is one aspect we will cover with you when shopping around for a suitable scheme.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

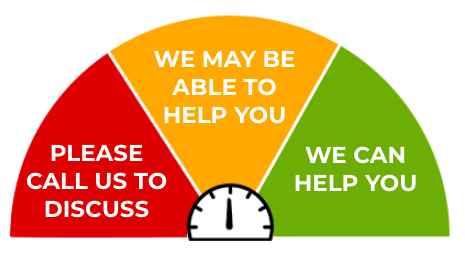

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner