Affordable Housing Schemes In Leighton Buzzard, Hertfordshire

& Surrounding Areas

There are a number of affordable housing schemes available to help you buy a home. This includes Help to Buy, Right to Buy and shared ownership schemes. Here at Stuart Brown Mortgage Services, we are available to provide advice and guidance on affordable home schemes in Leighton Buzzard, Hertfordshire & surrounding areas.

Help To Buy – Equity Loan

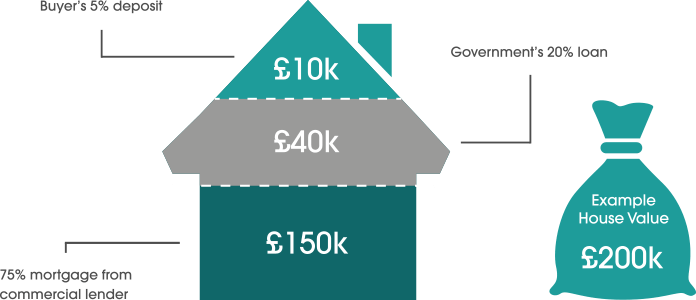

With a Help to Buy: Equity Loan the Government (via Homes and Communities Agency HCA) lends you up to 20% of the cost of your newly built home, so you’ll only need a 5% cash deposit and a 75% mortgage to make up the rest. The maximum full purchase price is £600,000.

Example: for a home with a £200,000 price tag

An initial monthly management fee of £1 is payable by direct debit from the start of the Agency loan until it is repaid.

Also after five years, you will be required to pay an interest fee of 1.75% of the amount of your Help to Buy shared equity loan at the time you purchased your property, rising each year after that by the increase (if any) in the Retail Prices Index (RPI) plus 1%.

The loan itself is repayable after 25 years or on the sale of the property if earlier.

On the sale of your home in the future, using the example above, at £210,000, you’d get £168,000 (80%, from your mortgage and the cash deposit) and you’d pay back £42,000 on the loan (20%). You’d need to pay off your mortgage with your share of the money.

You may, of course, wish to buy out of the shared equity loan in the future to fully own the property, a similar calculation would be carried out with £42,000 being required (plus costs) to do so.

For more information on affordable housing schemes (including advice on fees and paying back your loan) please call us today.

London Help To Buy

To reflect the current property prices in London, from February 2016 the Government is increasing the upper limit for the equity loan it gives new home-buyers within Greater London from 20% to 40%.

Shared Ownership

You can get a shared ownership home through a housing association. You buy a share of your home (between 25% and 75%) and pay rent on the rest.

There are different rules in Northern Ireland and Scotland. Contact your local authority to find out about buying a shared ownership home in Wales.

Eligibility

You can buy a home through shared ownership if your household earns £80,000 a year or less (or £90,000 a year or less in London) and any of the following apply:

- You’re a first-time buyer

- You used to own a home, but can’t afford to buy one now

- You’re an existing shared owner

How It Works

Shared ownership properties are always leasehold, basically, you buy a portion of the property and rent the remainder. The deposit required for the mortgage is a percentage of the portion you are buying and therefore lower than if you were buying the property outright.

Additionally, the effective purchase price of the property can be higher due to the way that lenders work out affordability. You will have to be approved by the Help to Buy agent who will also assess affordability too.

Older People

If you’re aged 55 or over you can buy up to 75% of your home through the Older People’s Shared Ownership (OPSO) scheme. Once you own 75% you won’t pay rent on the rest.

Disabled People

You can apply for a scheme called home ownership for people with a long-term disability (HOLD) if other Help to Buy scheme properties don’t meet your needs, for example, you need a ground-floor property. With this scheme, you can buy up to 25% of your home.

If you’re disabled you can also apply for the general shared ownership scheme and own up to 75% of your home.

Buying More Shares

You can buy more of your home after you become the owner. This is known as ‘staircasing’.

The cost of your new share will depend on how much your home is worth when you want to buy the share.

It will cost:

- More than your first share if property prices in your area have gone up

- Less than your first share if property prices in your area have gone down

The housing association will get your property valued and let you know the cost of your new share. You’ll have to pay the valuer’s fee as well as legal and other costs.

Selling Your Home

If you own a share of your home, the housing association has the right to buy it first. This is known as ‘first refusal’. The housing association also has the right to find a buyer for your home.

If you own 100% of your home, you can sell it yourself.

How to Apply

To buy a home through a shared ownership scheme contact the Help to Buy agent in the area where you want to live or give us a call to discuss further.

Mortgage Guarantee

The Help to Buy: mortgage guarantee scheme has closed to new loans as of 31 December 2016 as planned.

A wide range of 95% loan-to-value mortgage products are available from lenders anyway now though.

For information on your options please call us

Right To Buy

Right to Buy was introduced in 1980 and gives eligible social housing tenants the right to buy their home at a discount. Over the years, discount levels and eligibility criteria have varied. Concerned that the scheme had become unaffordable for many tenants the Government has introduced major changes to the Right to Buy since April 2012.

From 6 April 2017, maximum discounts are £78,600 across England and £104,900 in London. Discounts increase in April every year in line with any increase in inflation

You probably have the Right to Buy if you are a secure tenant of a Right to Buy landlord.

A secure tenant has the Right to Buy when they have spent at least 3 years as a public sector tenant.

You will only be able to purchase under the scheme if your house or flat is your only or principal home and is self-contained.

You cannot buy your home if a court makes a possession order which says that you must leave your home. Neither can you buy your home if you are an undischarged bankrupt, have a bankruptcy petition pending against you, or have made an arrangement with creditors (people you owe money to) and you still owe them money.

You may be able to exercise the Right to Buy jointly with members of your family who have lived with you for the past 12 months, or with someone who is a joint tenant with you.

Any land let together with your home (for example, gardens and garages) will usually be treated as part of your home.

There are exceptions to the Right to Buy. To find out more about our Right to Buy call us today.

Forces Help To Buy

The Forces Help to Buy (FHTB) scheme was introduced in April 2014 to allow service personnel to borrow an interest-free loan of up to 50% of their salary (to a limit of £25,000) which they can then use towards their deposit.

What you need to know:

- The loan is paid back over ten years through their monthly salary

- The scheme is running for three years and is intended to help more serving men and women buy their first home or buy a new home if they’re assigned elsewhere.

- Forces Help to Buy can’t be used on applications for an Equity Share Loan

- A maximum of two FHTB loans can be used per application.

To find out more about our Forces Help to Buy call us today.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

How Can I Apply for Affordable Housing Schemes?

In the first instance, the best thing to do is to speak to one of our advisors. There are a few different types of affordable housing schemes available and we will be able to determine which one suits you best. Your finances, lifestyle and other factors may influence your options. Whether you are a first-time buyer or an existing shared owner please give us a call and we will guide you through the process.

-

Which Affordable Housing Scheme is Right for Me?

There are several government schemes available, so do a bit of research and speak to one of our advisors to see which is right for you. The options include: Help to buy; Right to buy; and Shared ownership. They may differ depending upon your geographical location so you’ll need to know where you want to buy to get an accurate quote. Other variables, including your financial position and the amount of deposit, will also have a bearing on the deals you are offered. Do a bit of online research, then speak to one of our experts, and they will get you moving in the right direction.

Can I get approved for a mortgage? The mortgage application process can be difficult due to its significance in buying a home or refinancing. At Stuart Brown, we’re here to guide you through it, offering expert advice before you apply.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner