Buy to Let Mortgage Advice

Here at Stuart Brown Mortgage Services, we can provide you with buy to let mortgage advice. These are mortgages specifically available for borrowers to aid them to purchase investment properties. The anticipated rental income is primarily used to assess the amount that can be borrowed, and the calculation used by different lenders varies.

What the Lender Prefers:

- The borrower to already own their own home (with or without a mortgage)

- To earn over a set amount per annum e.g. £25000

- To have a good credit history

- For the rent to cover the proposed mortgage interest using a rental calculation, for example, £mortgage amount x arbitrary interest rate x 125% = minimum annual rent (sometimes 145%)

Lenders offer different schemes in a similar way to residential mortgages, they tend to have either higher pay rates or higher setup costs (sometimes both!)

In terms of the repayment method, they will allow Pure Interest Only as well as full repayment too, being more relaxed about the manner in which the mortgage is repaid as it is not your main residence. Also, Buy to Let mortgages are not currently (Nov 2015) regulated by the Financial Conduct Authority (although this could of course change in the future).

Purchasing any property is a big commitment, buying one to let out to tenants has additional aspects that need to be fully considered. We have a wealth of experience in arranging Buy to Let mortgages (and own several ourselves) so can give you pointers as to how they work and what other areas you need to consider i.e. record-keeping for tax purposes, dealing with letting agents etc. So, if you require buy to let mortgage advice, we are available to help you through the process. It is a good idea to speak to mortgage broker buy to let.

Our let to buy mortgage brokers can provide you with buy to let advice to ensure that you are aware of your options. Contact us today to speak to our expert buy to let mortgage advisors.

If you are wondering how to get a buy to let mortgage view our blog for advice today.

We can also offer help with Bridging, Development & Commercial Finance. For more information please follow the link below.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

Are buy-to-let mortgages more expensive?

Buy-to-let mortgages tend to be more expensive than typical residential mortgages. Buy-to-let mortgages are considered, by lenders, to be higher risk. You will also find that the deposit required is higher than for a residential mortgage, as are the arrangement fees.

-

How do buy-to-let mortgages work?

In principle, they work in the same way as residential mortgages. You need to provide details of your finances, including how you intend to repay the loan (e.g. Capital repayment mortgage or Interest-only mortgage).

Lending however is generally based upon the rental income expected from the future tenant, rather than your own earned income (as is the case with a residential mortgage). Each lender has a rental calculator that they will use to ascertain the mortgage affordability, this has different variables based upon lender, amount borrowed, pay rate and anticipated rent to be achieved. Also your tax status can impact too.

The deposit required to secure a buy-to-let mortgage is usually between 20% and 40% of the value of the property with interest rates on offer typically being lower with a bigger deposit.

-

What are buy-to-let mortgage rates?

As with any loan, buy-to-let mortgage rates vary widely. The rate you are offered will depend on your personal circumstances (income, outgoings, credit score, etc), as well as the deposit you put down and other factors including the rent to be expected.

With so many options available it can get overwhelming. To avoid getting flustered it’s best to find a financial advisor who can do the groundwork for you and present you with the best deal. Speak to an expert at Stuart Brown Mortgage Services today, and they will talk you through the process.

-

How do I get a buy-to-let mortgage?

Before you start the process you need to consider the following: the amount of deposit you need to provide; how you will cover the costs if the property is empty; how easy it will be to find a tenant and maintenance costs. You also need to consider taxation and purchase costs (including the likelihood of additional second property Stamp Duty if you already own your own home).

If you are confident that you have these covered, the next thing to do is to seek the advice of an experienced financial advisor. They will explain the process and detail all of the information you need to provide, in order to secure a suitable buy-to-let mortgage.

Once you have considered your options they will guide you through the application process. Speak to us today to see how we can help.

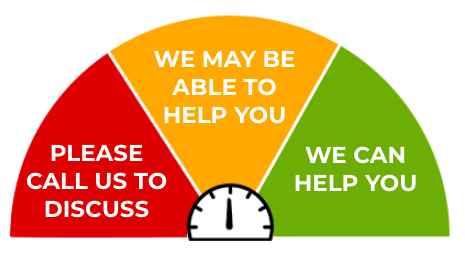

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner