Flexible Repayment Mortgages

Some mortgages allow you to vary payments for periods of time with flexible repayment mortgages. You could also make overpayments to help pay your mortgage off early. You may have the facility to take payment holidays or borrow money back to help you get through an expensive period.

Learn More About Flexible Repayment Mortgages Here

Offset Mortgages

Some schemes allow you to ‘offset’ savings against the mortgage to reduce the amount of interest payable, others incorporate current accounts, savings accounts, and credit cards.

Some of these schemes can be very complicated and it can be hard to keep track of the overall payment schedule. You should think carefully whether an offset repayment mortgage

is suitable for you before taking one out. It is often possible to get a cheaper pay rate by taking an alternative type of scheme.

Learn More About Offset Mortgages Here

Cashback Mortgages

Occasionally lenders offer smaller cashback schemes in combination with other rates i.e. discounts or fixed rate schemes. These smaller cashbacks are often a welcomed bonus to another scheme. This is known as cashback on mortgage payments, feel free contact us for more information.

Learn More About Cashback Mortgages Here

Mortgage Early Repayment Charges

Most schemes will have early repayment charges attached to them which mean if you do not keep the mortgage under the agreed scheme, for a specified period, then a penalty or ‘early repayment charge’ would become payable.

These charges are often expressed as a percentage of the loan being repaid and as such can run into thousands of pounds.

This is one aspect we will cover with you when shopping around for a suitable scheme.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

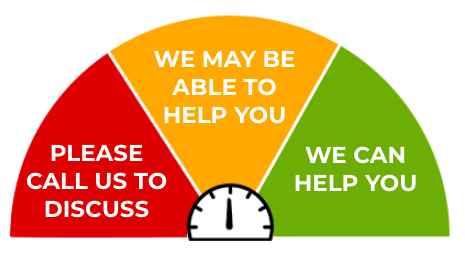

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner