Mortgage Financial Advisors in Leighton Buzzard

At Stuart Brown Mortgage Services, as your local mortgage financial advisors in Leighton Buzzard, we can provide you with expert mortgage broker advice. A mortgage is one of the biggest commitments of your life, it is important to take enough time to consider all the options available before committing to an application. This is where advice from an expert is essential.

A good mortgage broker will cover the costs involved in buying (solicitors, stamp duty, search fees, land registry, lender arrangement and valuation fees to name a few). They will also talk to you about the different repayment methods, look at different mortgage terms, the options as far as mortgage schemes (fixed and capped rates, tracker mortgages etc) and most importantly how much you can borrow and what it will cost.

Mortgage Advice now is mandatory for most parties, a Whole of the Market adviser will consider options from many lenders, something your bank will never do.

Advice from financial advisors will encompass the criteria of the lender to make sure that when you apply there is the best chance of the mortgage being approved.

What they will also do is minimise the time spent looking at the options being able to consider several routes for your new mortgage application at once, this also minimises the potential for several credit checks being done (something that can ruin your chances of getting a mortgage) as having recommended the best place to apply a single application is done.

The following pages will give an overview of the different aspects of a mortgage including buy to let mortgage advice and guidance on affordable housing schemes, but you should contact us to discuss your individual circumstances further if you require mortgage advice in Leighton Buzzard. Give us a call today for further information from our mortgage financial advisors in Leighton Buzzard.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

How Does a Mortgage Financial Advisor Help with Mortgages?

A mortgage financial advisor will make the whole process faster and smoother for you. They will ensure you have all of the correct documentation; help you to complete paperwork; access better deals and offer advice about which mortgage suits your lifestyle and needs. They will also save you time and ensure you pay no more for your mortgage than you need to.

-

How Long Are Mortgage Pre-Approvals Good For?

The pre-approval stage allows you to get confirmation that the lender will issue you with a mortgage, providing you meet their criteria, ahead of finding a property to buy. Most ‘Agreement in Principles’ are valid for 90 days, although some only have a 60 or 30 day expiration period. Lenders refer to these as a ‘Decision in Principle’, AIP or DIP, which all refer to the same thing.

-

How Long is the Wait for a Mortgage Pre-approval?

An agreement in principle can be obtained within about 10 to 15 minutes once basic info relating to your circumstances has been obtained i.e. income, credit commitments etc.

-

What Documents Are Needed For a Mortgage Application?

Most lenders will want proof of all or some of the following: ID (passport or driving licence), proof of income (3 months’ payslips or accountant report), 1-3 months bank statements, evidence of a deposit, details of any outstanding loans, overdrafts or credit card bills.

Your advisor will inform you of anything else they require and this will vary lender to lender.

A full mortgage offer can take anything from 1 – 4 weeks to be fully approved by the lender. This is after applying for the mortgage fully and includes a survey of the property as well as proof of income etc. An offer of mortgage is usually then valid for up to 6 months.

Other Areas we Cover

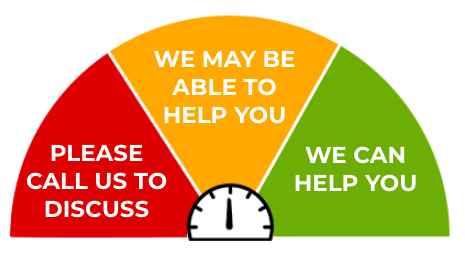

Can I get approved for a mortgage? The mortgage application process can be daunting because of its critical role in home buying or refinancing. At Stuart Brown, we’re dedicated to helping you navigate this process and providing expert guidance before you apply.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner