Mortgage Repayment Methods

When it comes to repaying your mortgage, lenders will offer two types of repayment methods. Capital & Interest is one method and Interest-only repayment is the other, in some cases lenders may allow you to combine the two. Currently, most mortgages being offered today are Capital & Interest. Here is everything you need to know about the two methods in greater detail:

Capital & Interest Mortgages

This is the most common type of repayment method for a mortgage and it works in the same way as most loans. Capital & Interest mortgages will consist of regular monthly payments for an agreed term to the lender. This is what the payment will be made up off:

- The capital: This is repaying the amount you initially borrowed.

- The interest: The charge made by the lender on the amount you owe.

Assuming you keep up with the correct payments, by the end of your mortgage term you will have paid off the loan in full. The mortgage term length is usually 10-30 years and the longer your term the more interest you will pay.

In the initial years of your mortgage term, a larger proportion of the monthly payment will go towards interest and a smaller amount towards capital. Over time the balance switches, with more going towards paying off your mortgage and less on interest.

This means during the first few years of your mortgage repayments it may feel like you are not paying much off the capital. However, in time, the amount of capital coming off the debt will accelerate until the mortgage term ends.

There are several types of Capital & Interest repayment mortgages including:

- Fixed-Rate Mortgages – The interest rate remains fixed for a set period.

- Tracker Rate Mortgages – The interest rate tracks the base rate plus a set percentage.

- Discount Mortgages – The Interest rate tracks the lender’s standard variable rate minus a set percentage.

- Flexible & Offset mortgages – these can be either fixed, tracker, discounted or variable rates.

Interest Only Mortgage

As the name suggests, an Interest-only mortgage is where you purely just pay the interest on the amount you borrowed. This will occur as payments on a monthly basis, with no payments of the original capital borrowed. However, the capital (initial amount you borrowed) will still need to be repaid at the end of your mortgage term.

Although an interest-only mortgage can make a mortgage more affordable, it is important to remember that in 10-30 years’ time you will still owe the lender a large lump sum. With interest-only mortgage payments, your main debt will remain the same size throughout the mortgage term.

This differs from a Capital & Interest mortgage as this method includes both your capital and interest in your monthly payment.

Since the Mortgage Market Review in 2014, the ability to take an interest-only mortgage has been severely limited. It was felt that too many mortgages were obtained with inappropriate or unrealistic means to achieve full payment.

As interest-only mortgage payments often require borrowers to save or invest in order to be able to pay off the full amount of their capital at the end, they are seen as a risky option. Interest-only deals are only advisable for those that have a lot of equity and are able to commit to a repayment where the capital lump sum is paid at the end of the term.

For more information on mortgage repayment options, please contact our expert team here at Stuart Brown Mortgage Services.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Frequently Asked Questions

-

What mortgage repayment options are there?

There are two types of mortgages – Capital repayment mortgage and Interest-only mortgages.

With a capital repayment mortgage, your monthly payments will include repayment of some of the capital borrowed, plus interest. At the end of your mortgage term, you should have paid off the initial amount borrowed.

Interest-only mortgages require you to pay only the interest on the amount you borrowed for the term of the mortgage. At the end of the mortgage term, you will still owe the full amount that you borrowed, and you will need to have a plan in place to pay this amount off.

If you’re unsure which type of mortgage is best for you, please give us a call and we can help you make your decision.

-

How are mortgage repayments calculated?

The amount you will have to pay monthly will be influenced by the amount that you want to borrow, repayment method and the length of the mortgage term selected. Also of course the interest rate agreed with your lender will impact the payments too.

-

Is it better to repay your mortgage or save?

As a general rule if your savings rate is higher than that payable on your mortgage then it would seem to be a good idea to put extra money into your savings account.

However, overpaying a small amount off the mortgage monthly can shave time off the mortgage and save a considerable amount of interest over the term. Many mortgage schemes have early repayment charges, however there are usually concessions that allow you to overpay within a certain limit, so that penalties are not payable as a result of overpayments.

There are several; factors to consider though (other than just interest rates), as individual circumstances can vary so much. Therefore, it would be prudent to seek the advice of a mortgage or financial adviser, to get a personalised plan.

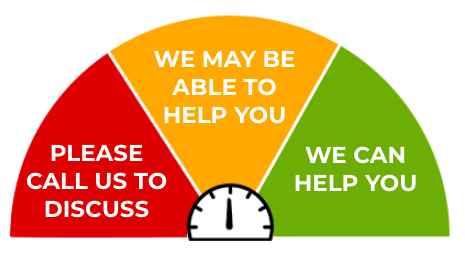

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner