Protection Insurance Advice

Protection is an important part of any mortgage, so we provide protection insurance advice to make sure you have the cover you need. Our insurance advisors can help you to find the best option when it comes to insurance protection.

You, Your Mortgage & Your Family

A mortgage is probably the biggest financial commitment you will ever enter into. Very few families are adequately insured. It is important that you review your cover periodically and whenever your circumstances change. At Stuart Brown Mortgage Services our personal insurance advisors will advise you on the following key areas, taking you through the reasons why each is important and helping you to prioritise those that are most important to you.

- Life Assurance

- Critical Illness Insurance

- Accident & Sickness Cover

- Income Protection

- Unemployment Protection

- Buildings & Contents Insurance

Unlike most banks, building societies and other mortgage brokers, we arrange cover on a ‘Whole of Market’ basis (i.e. a wide range of different insurance companies).

This makes sure that you are offered the cheapest premiums and are more able to afford the cover that would help you meet your commitments should the worst happen.

It is particularly important for you to consider the consequences of under protection and whether in fact, you should be covering more than just the mortgage amount. Too few people have enough protection not understanding what they should have, and why it is important, readily insuring their dog, cat or mobile phone but being reluctant to spend any money insuring themselves!

Incidentally, as insurance and financial advisors, we can arrange cover for you even if we have not arranged your mortgage.

Buildings & Contents Insurance

We can arrange cover from a number of insurers in respect of buildings and contents insurance cover. You do not need to be moving home for us to do so either.

Get in touch with us today if you require protection insurance advice to speak to one of our general insurance advisors.

If it is an immediate quote that you are after then contact us by telephone on either Herts: 01442 252 040 or Beds & Bucks: 01525 877 650 or Mobile: 07710 770 969. You can also email us at advice@sbms-online.co.uk

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

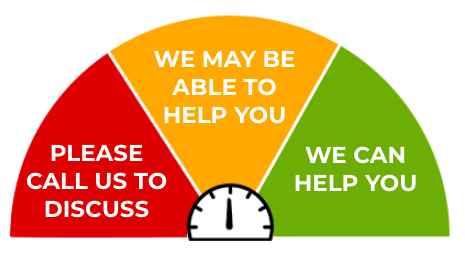

Can I get approved for a mortgage? Applying for a mortgage can be complex and stressful, given its key role in purchasing a home or refinancing. At Stuart Brown, we are committed to guiding you through this process and offering expert advice before you submit your application.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner