Purchase Purchasing a property can be a stressful process as it is a big commitment, so as leading mortgage advisors we are here to help you with the application process.

More Information

Remortgaging Expert advice and guidance on remortgaging. As leading mortgage advisors, we can help you through the stressful process of your applications.

More Information

First Time Buyers We provide complete guidance for first-time buyers so you can be aware of all the different options available for you with your new mortgage.

More Information

Buy To let & Commercial We have a wealth of experience in arranging buy to let mortgages, so we can take you through everything that you need to consider in the process.

More Information

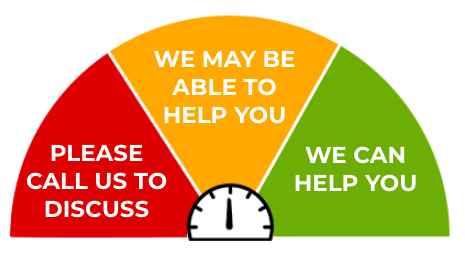

Can I get approved for a mortgage? Getting approved for a mortgage can be a stressful process as it is one of the most important steps in the home buying or remortgaging procedure. Here at Stuart Brown we are available to help you through the process of gaining approval for a mortgage and can offer you expert advice before you submit your application.

Mortgage Advisor in Leighton Buzzard

Stuart Brown are experienced mortgage advisors in Leighton Buzzard, proudly serving Hertfordshire, Bedfordshire and Buckinghamshire. Founded by Stuart and Sharon in 2003, after over a decade in the financial industry, we’ve built a strong reputation for personal, expert advice. We’re not a large, faceless firm , just friendly, professional advisors here to help, whether you’re buying, moving, re-mortgaging or investing in property.

If you are looking for local financial advice, our local financial advisors in Leighton Buzzard can provide you with all of the advice to help you in making those difficult decisions.

If you are wondering when to use a mortgage broker, check out our article.

Mortgage Brokers Leighton Buzzard

As local mortgage brokers in Leighton Buzzard, we pride ourselves in providing the best advice, excellent customer service and try our utmost to actively look out for our customers throughout the home buying process. An essential part of our business is our client’s willingness to recommend us to family, friends & colleagues. From advice on mortgages and how much can you borrow to guidance on solicitors & conveyancers and loans, at Stuart Brown Mortgage Services our mortgage brokers in Bedfordshire are here to provide you with the assistance you require. If you would like to enquire about a quote or would like to find out more information about our services, contact our local mortgage brokers in Leighton Buzzard today.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up the repayments on your mortgage.

Where We’re Located – Mortgages Advisors and Brokers in Bedfordshire

Other Areas we Cover

Frequently Asked Questions

-

What does a mortgage broker do?

A mortgage broker helps you find and secure the right mortgage by comparing deals from multiple lenders. They assess your financial situation, explain your options, and handle the application process to save you time and potentially secure a better rate than going directly to a bank.

-

Is it better to use a mortgage broker or go directly to a lender?

Using a mortgage broker can give you access to a wider range of mortgage deals, including exclusive rates not available directly to the public. A broker will also guide you through the paperwork, explain complex terms, and help match you with the most suitable lender for your circumstances.

-

How much deposit do I need for a mortgage in the UK?

In the UK, most lenders require a deposit of at least 5%-10% of the property’s purchase price. However, putting down 10-20% can give you access to better interest rates and lower monthly repayments.

-

Can a mortgage broker help if I have a bad credit score?

Yes, many mortgage brokers specialise in helping people with bad credit find suitable mortgage options. They can approach lenders who are more flexible and experienced in working with customers who have a less-than-perfect credit history.

-

How long does a mortgage application take?

On average, a mortgage application takes between two to six weeks from submission to approval, depending on the lender, your financial circumstances and how quickly documents are provided.

-

What documents do I need for a mortgage application?

You will typically need proof of identity, proof of address, recent bank statements, payslips or proof of income and details of your outgoings. Self-employed applicants may also need two to three years of tax returns.

-

Do mortgage brokers charge a fee?

Some mortgage brokers charge a fee, which can be a fixed amount or a percentage of the loan, while others are paid by the lender. At SBMS, fees will be clearly explained upfront so you know exactly what to expect.

Our Testimonials

Book An Appointment If you would like to arrange a telephone call or meeting, please fill in your details below and we will respond as soon as possible.

Monthly Budget Planner

Monthly Budget Planner Monthly Budget Planner

Monthly Budget Planner